Q2 2020 Edition Of Venture Investments In the Space Industry

Jul 15, 2020

Welcome to the Q2 2020 edition of Venture Investments in the Space Industry.

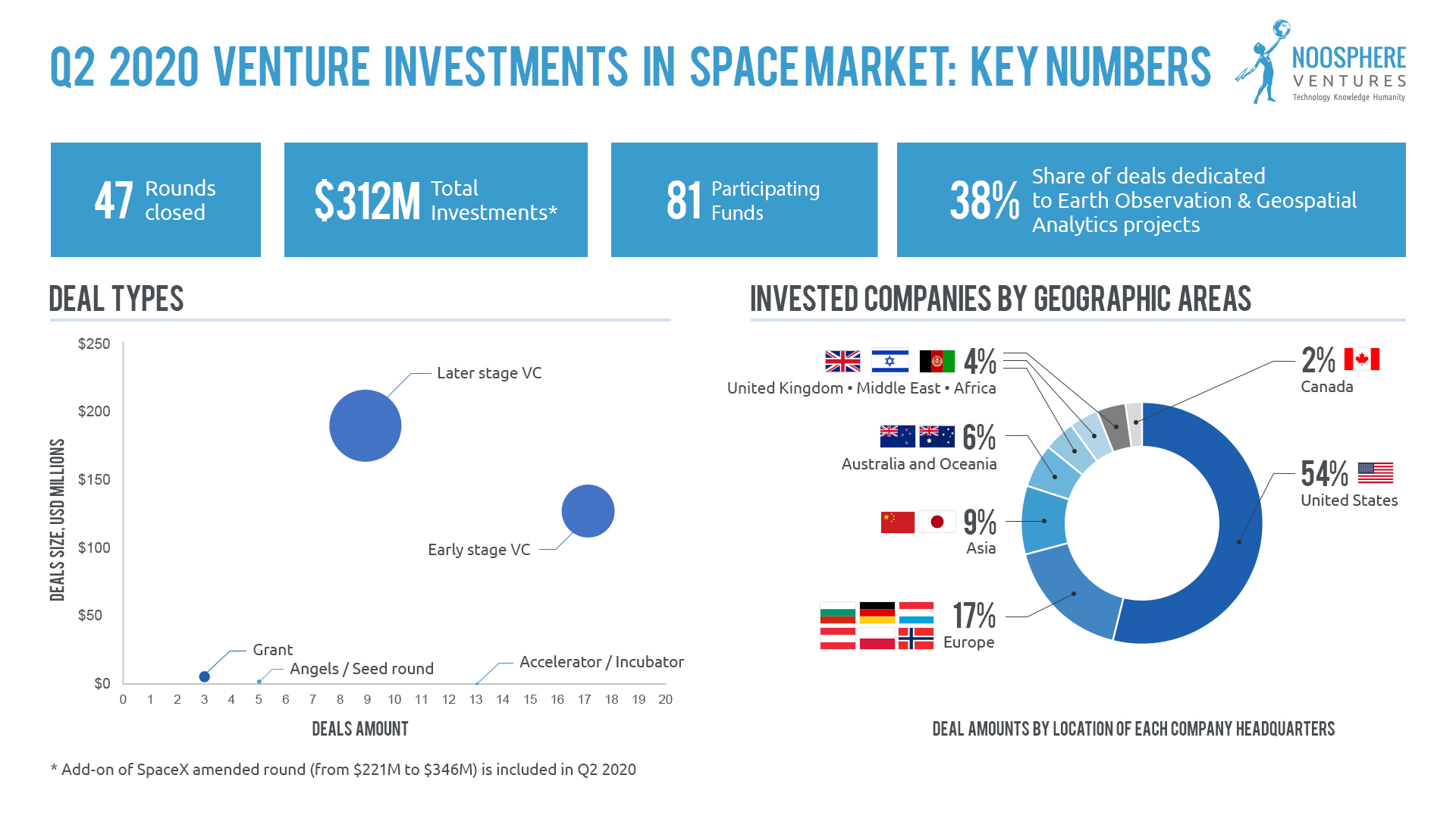

Q2 2020 Report shows a significant decrease in cash flow for the industry because of the COVID-19 pandemic’s impact on the economy. Nevertheless, a sustained upward trend in interest demonstrates 2020 to be the year of strong public-private partnerships with new launch companies on the stage. Let’s look at a detailed report on Venture Investment In the Space Industry, prepared by Noosphere Ventures.

Download Venture Investments In the Space Market. Q2 2020 Report

2020 was the year of commercial space travel, as strong private-public partnerships and new launch companies were refined.

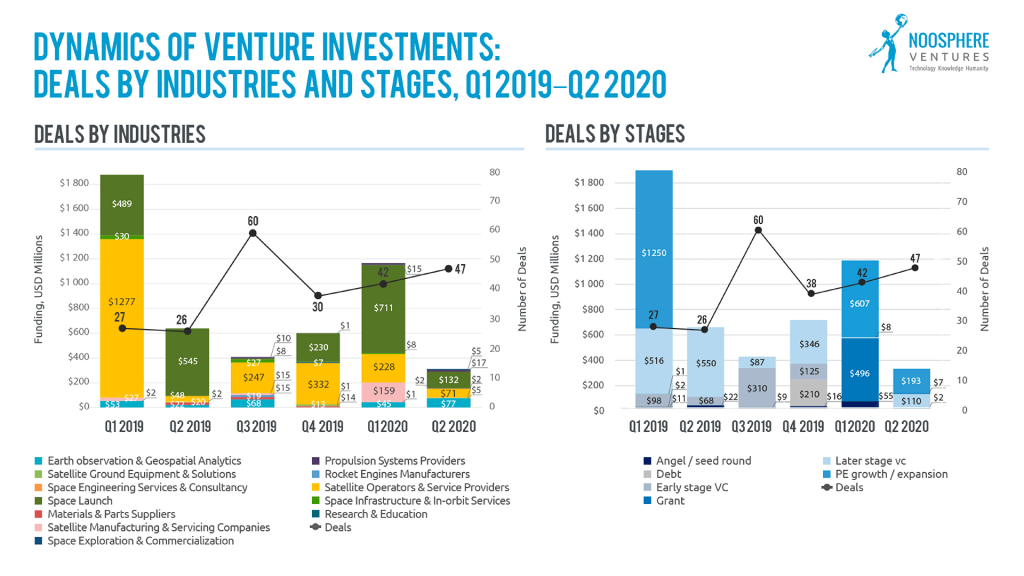

According to public data collected by Noosphere Ventures, 47 rounds of financing were closed in Q2 2020, with a total investment of US$312M. Compared to Q1 2020, even with five more rounds, investments dropped 4 times. Up to 81 funds participated in the rounds. Most of the completed contracts were early-stage VC and Angel/seed funding.

Half of the companies which received investment are in the US. Compared to Q1 2020 numbers, the Asian market share dropped from 17% to 9%, Australia and Oceania grew by 4%.

The top 3 biggest deals of Q2 2020 were:

- $346M investment in SpaceX, which aims to fund three programs: Crew Dragon spacecraft; Starlink, a network of thousands of small internet satellites and Starship, a massive rocket to send people and cargo to Mars;

- $38M investment in Commsat – the fundraising comes as Commsat is planning to create a satellite internet platform;

- $23M investment in Taranis – the capital raised will be used to enhance its positions in North and South America and expand its expertise.

The second group of the largest funding deals were Myriota ($17M), Tianbing Technology ($14M), GHGSat ($14M), and Enview ($12M).

As for M&A deals, among the largest was a $140M purchase by Maxar for the remaining 50% share in Vricon, giving them full ownership. Also, AE Industrial Partners created Redwire by combining several businesses.

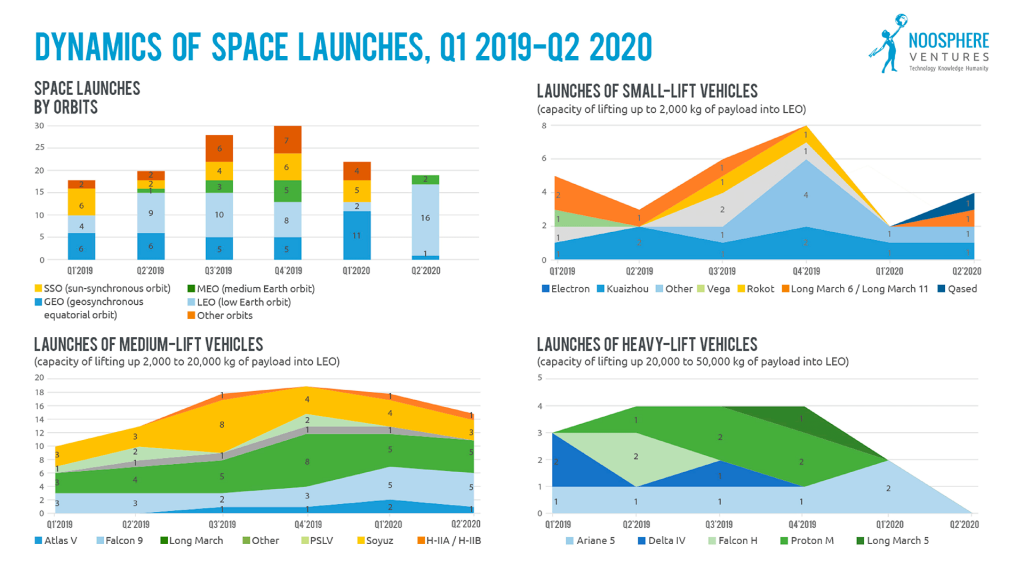

The setback caused by the coronavirus pandemic and the related economic downturn has negatively impacted the number of space launches. Medium-lift vehicle launches fell from 18 to 14, none of the heavy-lift vehicles were launched in Q2 and only small-lift vehicles doubled the number of launches from 2 to 4.

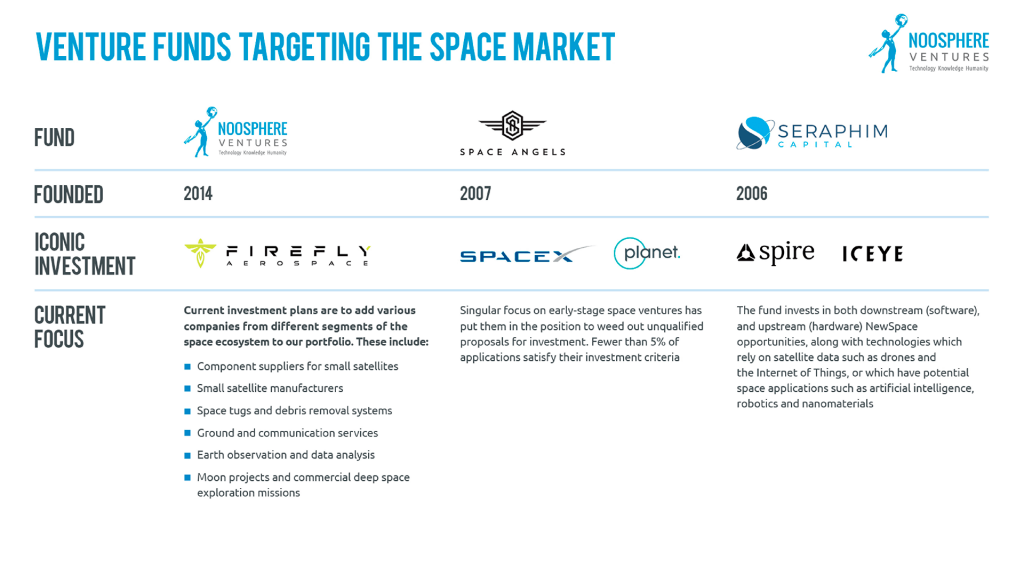

Q2 report highlights Noosphere Ventures (investments in Firefly Aerospace), Space Angels Network (investments in SpaceX and Planet), and Seraphim Capital (investments in Spire and Iceye) as top funds with successful space-tech oriented portfolios.

About Noosphere Venture Partners

Noosphere Venture Partners LP is a space-focused international asset management firm headquartered in Menlo Park, California, USA. It invests in projects from all over the world and is mainly focused on space and the development of a New Space concept.

The mission of Noosphere Venture Partners LP is to develop, grow and accelerate industry-leading companies on a global scale.

Max Polyakov, managing partner of Noosphere Venture Partners LP, is the founder and advisor of a number of startups that have grown into international businesses. These include companies such as HitDynamics Ltd, Cupid Plc, Maxymiser Ltd, Murka, and Firefly Aerospace.

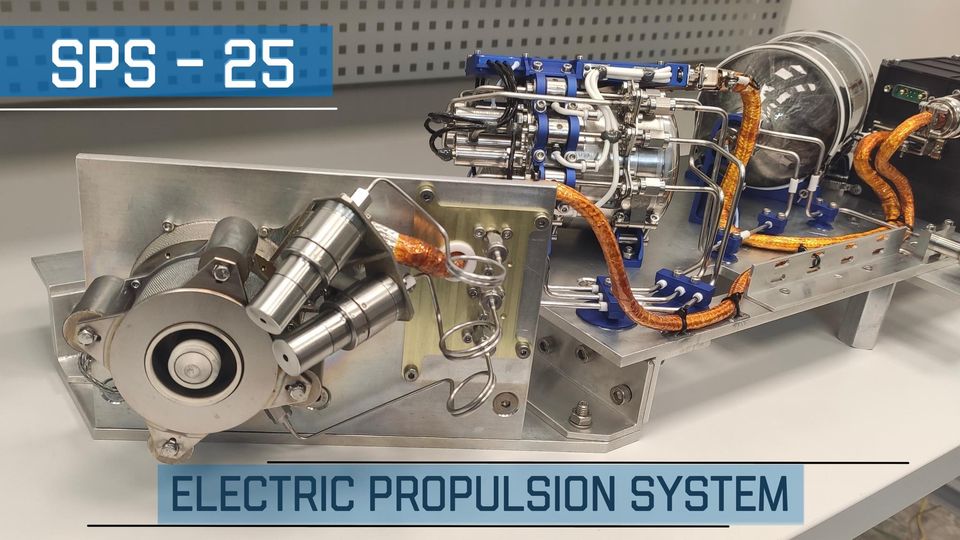

Noosphere Venture Partners (NVP) manages a global portfolio of companies with offices all over the world and 2,000+ specialists. NVP has invested in different projects and companies, including Firefly Aerospace, a small-satellite launch vehicle startup. The company is also investing in the Earth Observation System Data Analytics platform (EOS DA), Space Electric Thruster Systems (SETS) and D-Orbit.

If you have a relevant business that is looking for venture capital funding, submit your business plan for review: [email protected].

Our professional team has an excellent investment and technical background, and our expertise helps to assess the prospects of projects and then pursue them for many years to come. For questions & feedback about the report: [email protected].

Follow our Facebook page to know more about space investment

Read more from Noosphere Ventures:

- SETS’ SPS-25 Propulsion System Proves Successful in Space Testing Despite Challenging Circumstances in Ukraine

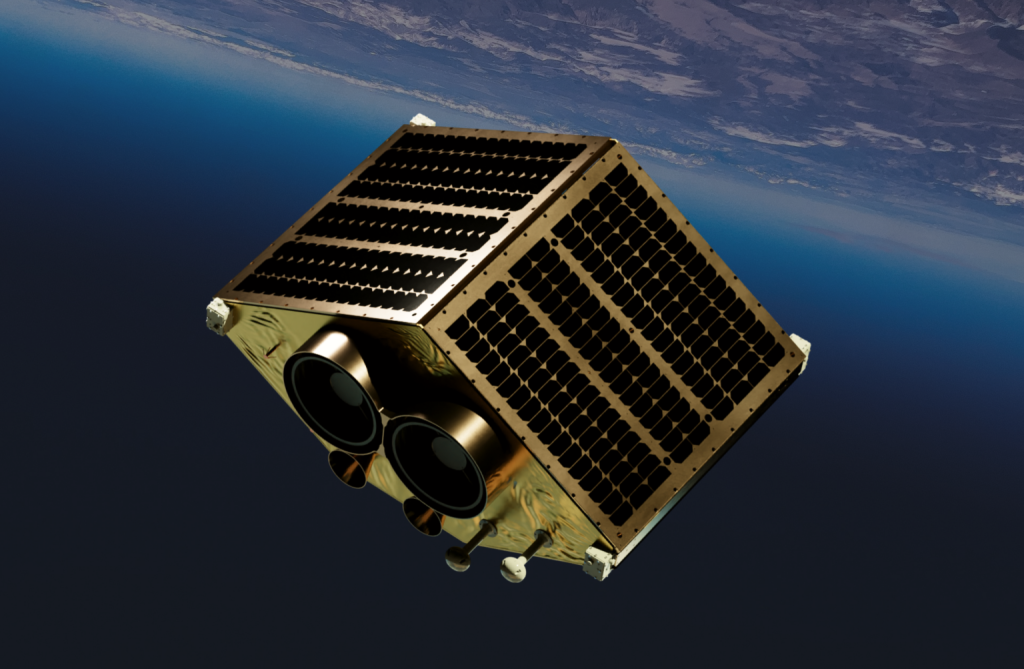

- EOS Data Analytics launched EOS SAT-1, the first satellite of its EOS SAT constellation

- EOSDA And Ursa Space Entered Into An Agreement

- D-Orbit charts ambitious course for space logistics business

- SETS delivered 2nd SPS-25 Hall thrusters system for commercial mission

- D-Orbit wins contract to work on Space Rider reusable space vehicle

- EOSDA Contracted An Agreement With GEOSAT

- Noosphere Ventures LP to sell a major stake in Firefly Aerospace to AE Industrial Partners

- EOS SAT First Satellite Provided By Dragonfly Aerospace

- Firefly Aerospace is one step closer to landing on the Moon